Understanding Springfield Payday Loans

Defining Payday Loans and Their Purpose

Springfield payday loans are short-term, small-dollar loans designed to help borrowers meet immediate financial needs. They’re typically repaid on your next payday, hence the name. These loans are not intended for long-term financial solutions, but rather for addressing unexpected expenses like car repairs or medical bills. Think of them as a temporary bridge to help you get through a short-term crisis, not a solution for ongoing financial challenges. Understanding this crucial difference is key to responsible borrowing.

Payday loans in Springfield, like elsewhere, involve borrowing a relatively small amount of money, usually a few hundred dollars. You agree to repay the loan, plus fees and interest, on your next payday. High interest rates are a significant characteristic of payday loans, so careful consideration of the total repayment cost is crucial before taking out a loan. “Always compare offers from multiple lenders to find the best terms and avoid predatory lending practices.” Remember, while convenient, payday loans can be expensive if not managed carefully and should be used only as a last resort for true emergencies.

Payday Loan Regulations in Springfield, Missouri

Springfield, Missouri, like many states, regulates payday loans to protect consumers. These regulations limit the amount a lender can charge in fees and interest. The Missouri Division of Finance oversees these lending practices. It’s crucial to understand these limits before applying for a Springfield payday loan. Ignoring these regulations could lead to exploitation. Borrowers should always check the official state website for the most current information on payday loan interest rates and fees.

“Always compare loan offers from different lenders to find the best terms.” Understanding the total cost, including all fees and interest, is paramount. Failing to do so can result in unexpected debt. Remember, short-term loans in Springfield should be used only for genuine emergencies. Responsible borrowing is key to avoiding a cycle of debt. Consider alternatives like credit counseling or negotiating with creditors before resorting to payday loans, especially if you foresee difficulties in repayment. “Seek professional financial advice if you’re struggling to manage your finances.”

Who Qualifies for a Payday Loan in Springfield?

Securing a Springfield payday loan typically requires meeting specific criteria. Lenders usually need proof of consistent income, a valid bank account, and a government-issued ID. Your employment history and credit score will also be considered, though payday loans are often marketed as a solution for individuals with less-than-perfect credit. It’s crucial to remember that even with less-than-stellar credit, lenders assess risk based on your current financial stability and ability to repay. Therefore, demonstrating a reliable income source is key to approval.

Many lenders in Springfield will have minimum age requirements, usually 18 years or older. They’ll also verify your employment details and current address to ensure you’re a resident of Springfield and can easily repay the loan. Payday loan amounts are typically capped by state regulations, so researching those limits is essential before applying. “Understanding these requirements beforehand prevents disappointment and wasted time, allowing you to find the best option for your emergency financial needs in Springfield.” Remember to carefully read the loan agreement before signing to fully understand the terms and avoid unexpected fees or interest rates.

Finding Reputable Lenders in Springfield

Identifying Licensed and Regulated Lenders

Navigating the world of payday loans requires caution. Not all lenders operate with the same level of transparency and ethical standards. In Springfield, as in other areas, it’s crucial to verify a lender’s licensing and regulatory compliance. Check the Missouri Division of Finance’s website for a list of licensed lenders. This simple step can significantly reduce your risk of encountering predatory lending practices. Always independently verify any information provided by a lender.

Confirming a lender’s legitimacy protects you from scams and high-interest rates. Look for clear disclosures of all fees and interest rates upfront. Avoid lenders who pressure you into quick decisions or who are unwilling to answer your questions thoroughly. “Remember, a reputable lender will prioritize transparency and treat you with respect.” Compare offers from several licensed lenders before committing to a loan to secure the best terms for your specific financial circumstances. Utilize online resources and consumer protection agencies to further investigate any lender you’re considering.

Comparing Interest Rates and Loan Terms

Interest rates significantly impact the overall cost of a payday loan. Always compare rates from multiple lenders before committing. Pay close attention to the Annual Percentage Rate (APR), which reflects the total cost of borrowing, including fees. Avoid lenders advertising exceptionally low rates, as hidden fees can inflate the true cost. Shop around and carefully review the terms. Remember, lower APRs generally translate to lower overall costs.

Loan terms typically specify the repayment period, usually two to four weeks for payday loans in Springfield. “Understand the repayment schedule completely before accepting a loan to avoid unexpected fees for late payments.” Consider the amount you can comfortably repay within the given timeframe. Choosing a loan term that aligns with your financial capacity prevents you from falling into a cycle of debt. Always prioritize responsible borrowing practices. Don’t borrow more than you can repay on time.

Reading the Fine Print: Understanding Fees and Charges

Before committing to a Springfield payday loan, meticulously review all fees and charges. Payday loans often involve high interest rates. These rates can significantly increase your total repayment amount. Look for a clear breakdown of all costs, including APR (Annual Percentage Rate), origination fees, and any potential penalties for late payments. Compare these figures across multiple lenders. Don’t hesitate to ask questions if anything is unclear.

“Understanding the total cost of borrowing is crucial to making an informed decision.” Pay close attention to how fees are calculated. Some lenders might charge a flat fee, while others base charges on the loan amount or repayment period. Consider the total cost, not just the initial loan amount. This will help you determine if the loan is truly affordable and suitable for your financial situation. Remember that even a small loan with high fees can quickly become a significant burden if you struggle to repay on time. Choosing the right lender with transparent fees is key to avoiding future financial problems.

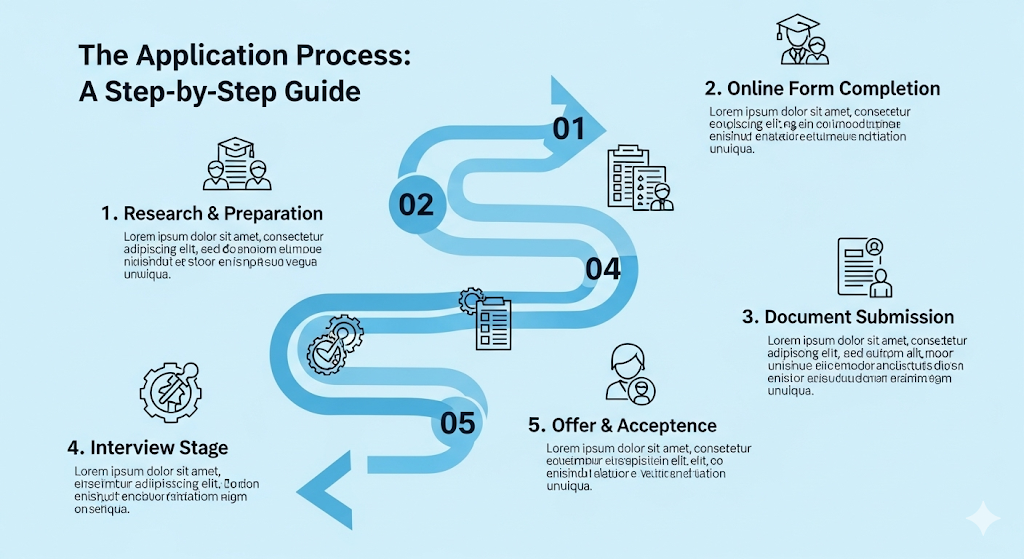

The Application Process: A Step-by-Step Guide

Gathering Required Documents and Information

Before applying for a Springfield payday loan, gather all necessary documents. This ensures a smooth and efficient application process. You’ll typically need a valid government-issued photo ID, proof of income (pay stubs, bank statements showing regular deposits), and your current bank account information. Missing even one document can delay approval.

Confirm the lender’s specific requirements. Different lenders in Springfield may have slightly varied needs. Some may request proof of address, such as a utility bill. Others might ask for employment verification. “Always check the lender’s website or contact them directly to confirm the exact list of required documents *before* you begin the application.” This proactive step saves time and prevents application delays. Being prepared is key to obtaining a Springfield payday loan quickly.

Completing the Online or In-Person Application

Applying for a Springfield payday loan, whether online or in person, typically requires providing personal and financial information. Online applications often involve a secure portal where you’ll input details such as your name, address, Social Security number, bank account information, and employment history. Be absolutely certain that the website uses encryption (look for “https” in the URL) to protect your sensitive data. Inaccurate information will delay or prevent approval. Carefully review all forms before submission.

In-person applications at a physical Springfield payday loan location follow a similar process. You’ll complete a paper application, providing the same information as the online version. Be prepared to present valid identification, such as a driver’s license or state-issued ID card, as well as proof of income, like recent pay stubs. “Remember to ask questions if anything is unclear; reputable lenders welcome inquiries and will explain the terms and conditions thoroughly.” Friendly and helpful staff can address any concerns you might have about the application process or the loan itself. Choosing a reputable lender is paramount to ensure a safe and transparent transaction.

Reviewing Loan Terms Before Acceptance

Before accepting any Springfield payday loan offer, meticulously review all terms and conditions. Pay close attention to the Annual Percentage Rate (APR), which reflects the total cost of borrowing. This includes not just the interest but also any fees. A high APR can significantly increase the overall cost, potentially making the loan unaffordable. Compare APRs from different lenders to find the best deal. Don’t hesitate to ask questions if anything is unclear; a reputable lender will gladly explain all aspects of the agreement.

Understanding the repayment schedule is crucial. Note the due date and the total amount due. Ensure this aligns with your anticipated income. Failing to repay on time incurs late fees, which can quickly escalate the debt. “Carefully read the details about loan extensions or rollover options, as these often come with additional charges.” Also, understand the lender’s collection practices in case of default. Choose a lender with transparent and reasonable policies. Always prioritize responsible borrowing and only borrow what you can comfortably repay.

Responsible Borrowing and Avoiding Pitfalls

Creating a Realistic Repayment Plan

Before applying for a Springfield payday loan, meticulously plan your repayment. Understand the loan’s terms completely, including the high interest rates and short repayment period. Carefully review your monthly budget to identify areas where you can cut expenses. Consider using budgeting apps or spreadsheets to track income and expenditures. This detailed process will give you a clear picture of your financial situation and available funds for loan repayment.

“Failing to create a realistic repayment plan is a major pitfall of payday loans.” Prioritize the loan repayment in your budget. Treat it like a critical bill, ensuring the payment is made on time to avoid additional fees and penalties. Explore alternative solutions like negotiating with creditors for payment extensions or seeking free credit counseling. Remember, responsible borrowing involves careful planning and commitment to repayment, mitigating the risk of a debt cycle. “Ignoring this crucial step can lead to a cascade of financial problems.”

Understanding the Risks of Payday Loan Debt

Payday loans, while offering quick access to cash in Springfield, carry significant risks. The high interest rates are a major concern. These rates can easily exceed 400% annually, making it extremely difficult to repay the loan on time. Missing a payment triggers further fees and charges, quickly escalating the debt and creating a cycle of borrowing. This can lead to a serious financial strain, impacting your credit score and overall financial well-being. Consider this before seeking a Springfield payday loan.

Failing to understand the terms and conditions fully is another common pitfall. Many borrowers are unaware of the hidden fees and charges until it’s too late. Read the fine print carefully before signing any agreement. Failing to do so can result in unexpected costs and further debt accumulation. “A thorough understanding of the loan agreement, including all fees and repayment schedules, is crucial to avoid unforeseen financial hardship.” Explore all alternatives, like credit counseling or borrowing from friends and family, before resorting to a payday loan if possible. Remember, responsible borrowing means being fully informed and prepared.

Exploring Alternatives to Payday Loans

Before considering a Springfield payday loan, explore alternative solutions. Many resources offer emergency financial assistance without the high interest rates and potential for debt traps. Check with local charities and non-profit organizations, such as the Salvation Army or local food banks, for help with immediate needs like food or rent. They may offer short-term financial aid or connect you with other support services. Consider reaching out to your church or religious community; many offer assistance programs to their members.

Credit unions frequently provide smaller, more affordable loans with better terms than payday lenders. They often offer small-dollar loans designed to help members through temporary financial hardship. Exploring these options first can save you significant money in the long run. “Always prioritize exploring these alternatives before resorting to a high-interest payday loan, as the long-term costs can far outweigh the short-term benefits.” Additionally, consider contacting your creditors directly to discuss potential payment plans or extensions. Open communication can often lead to workable solutions that avoid the need for a payday loan entirely.

Alternatives to Payday Loans in Springfield

Small Personal Loans from Banks or Credit Unions

Banks and credit unions offer small personal loans as a viable alternative to payday loans in Springfield. These loans typically have lower interest rates than payday loans, making them a more affordable option for borrowers. Before applying, carefully compare interest rates, fees, and repayment terms from several institutions. Credit unions, in particular, often cater to members’ needs with more flexible lending options and potentially lower interest rates. Checking your credit score beforehand is advisable, as a higher score will improve your chances of approval and secure better terms.

Securing a personal loan from a financial institution requires a more rigorous application process than payday loans. You’ll need to provide documentation like proof of income and employment history. This more stringent vetting process helps ensure responsible lending practices. While the application process might take longer, the benefits of lower interest rates and more manageable repayment plans usually outweigh the inconvenience. “Remember to always compare offers from multiple lenders before committing to a loan to find the best fit for your financial situation.” Consider the total cost of the loan, including interest and fees, before making your decision.

Community Resources and Financial Assistance Programs

Springfield offers a network of support for residents facing financial hardship. Many local charities and non-profit organizations provide emergency financial assistance in the form of grants or short-term loans with significantly lower interest rates than payday loans. These groups often work with individuals to create budgeting plans and offer financial literacy classes, equipping them with long-term solutions. Examples include the Salvation Army, local churches, and community action agencies. Remember to check their eligibility requirements, which often involve income verification and residency checks.

Before turning to high-interest Springfield payday loans, explore government programs. The Springfield Department of Human Services, for instance, may offer assistance programs for families struggling with utility bills, rent, or food insecurity. Federal programs like the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF) can also provide crucial support. “Thoroughly researching and applying for these programs could significantly reduce your reliance on predatory lending options and provide much-needed stability.” Contact your local social services office to discover available resources specific to your needs.

Negotiating with Creditors for Extended Payment Plans

Facing unexpected expenses can be stressful. Before considering a Springfield payday loan, explore negotiating with your creditors. Many companies offer extended payment plans or hardship programs to help customers manage debt. Contact your creditors immediately. Explain your financial situation honestly. They may be willing to work with you. A missed payment impacts your credit score. A proactive approach is often more beneficial.

Proposing a written agreement outlining a modified payment schedule demonstrates responsibility. This demonstrates your commitment to repayment. Consider offering a smaller, more manageable payment upfront. This shows good faith. Remember to document all communication, including dates, times, and the agreed-upon terms. Thorough record-keeping protects you. “Failing to communicate with creditors may result in more serious consequences than proactively seeking a payment plan.” Explore all options before resorting to high-interest payday loans in Springfield.

Frequently Asked Questions about Springfield Payday Loans

What happens if I can’t repay my payday loan?

Failing to repay a Springfield payday loan can have serious consequences. Your lender will likely attempt to collect the debt through repeated phone calls and letters. They may also report your delinquency to credit bureaus, negatively impacting your credit score. This can make it harder to secure loans, rent an apartment, or even get a job in the future. It’s crucial to understand these potential repercussions before taking out a payday loan.

Consider exploring alternatives if repayment seems unlikely. Contact your lender immediately to discuss potential repayment options, such as extending the loan term or setting up a payment plan. Seeking help from a credit counseling agency could also be beneficial. “Ignoring the problem will only worsen the situation, potentially leading to legal action, wage garnishment, or even debt collection agency involvement.” Remember, responsible borrowing is key. Always borrow only what you can comfortably repay on the due date. Proactive communication with your lender is crucial to mitigate the risks associated with non-repayment.

Are there penalties for early repayment?

Most Springfield payday loan providers don’t penalize borrowers for early repayment. This is a significant benefit compared to some other loan types. However, it’s crucial to always check the specific terms and conditions of *your* loan agreement. Some lenders may charge a small processing fee for early repayment, although this is less common than penalties for late payments. Always read the fine print to avoid unexpected charges.

Before signing any payday loan agreement in Springfield, Missouri, or anywhere else, confirm the early repayment policy with the lender. Ask directly about any potential fees. “Don’t assume anything; clarify all aspects of the repayment process upfront to ensure a smooth and transparent transaction.” Keeping a copy of your loan agreement and all communication with the lender is a smart practice. This documentation helps resolve any disputes or misunderstandings that may arise. Remember, understanding your loan terms is key to responsible borrowing.

What are the legal implications of defaulting on a payday loan?

Defaulting on a payday loan in Springfield, Missouri, has serious legal consequences. Lenders can pursue various collection methods, including sending your debt to collections agencies, which can negatively impact your credit score. This can make it harder to rent an apartment, get a loan, or even secure some jobs. Furthermore, lawsuits are a possibility, potentially leading to wage garnishment or bank account levies. The specific actions a lender can take are governed by Missouri state law, so understanding your rights is crucial.

Remember, payday loans are designed to be short-term solutions. Before borrowing, carefully assess your ability to repay on time. Failing to do so can create a cycle of debt that’s difficult to escape. “Ignoring the debt won’t make it disappear; it will only worsen the situation and potentially lead to severe financial and legal repercussions.” Consider exploring alternative options like credit counseling or negotiating with your lender before defaulting. Springfield residents struggling with loan repayment should seek advice from a reputable financial counselor or legal professional.