What is PMI on Mortgage Loan

When you’re considering buying a home, you might come across the term PMI. But what exactly is PMI on a mortgage loan, and why is it important? In this article, we’ll break down everything you need to know about Private Mortgage Insurance (PMI), helping you understand its role in your home buying journey.

Understanding PMI

PMI stands for Private Mortgage Insurance. It’s a type of insurance that protects lenders if a borrower stops making payments on their mortgage. Lenders typically require PMI for borrowers who make a down payment of less than 20% of the home’s purchase price. This insurance reduces the lender’s risk, allowing more people to become homeowners even if they can’t put down a hefty 20% initially.

The Basics of PMI

Private Mortgage Insurance is a financial product designed to protect lenders. When borrowers default on their mortgage payments, lenders face significant financial risks. PMI acts as a safety net, covering a portion of the lender’s losses. This protection encourages lenders to offer loans to individuals who might not have the means to make a substantial down payment. By reducing the lender’s risk, PMI opens doors for many aspiring homeowners.

How PMI Facilitates Homeownership

One of the primary benefits of PMI is that it enables more people to enter the housing market. Without PMI, many potential buyers would be locked out of homeownership due to the high down payment requirements. PMI allows individuals to purchase a home with a smaller down payment, often as low as 3% to 5%. This affordability can be a game-changer for first-time buyers and those without significant savings.

The Lender’s Perspective

From the lender’s point of view, PMI is a crucial tool in risk management. Mortgages with low down payments are inherently riskier because they leave less equity in the property. In the event of a default, the lender is at greater risk of losing money. PMI mitigates this risk by compensating lenders for losses that exceed the borrower’s equity. This reassurance encourages lenders to offer competitive mortgage terms to a broader range of borrowers.

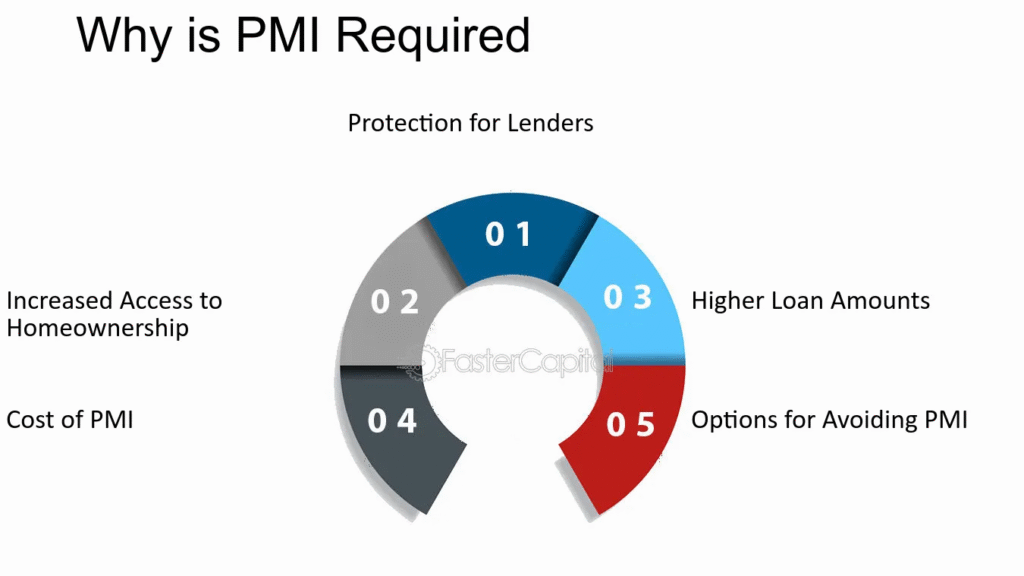

Why Is PMI Required?

PMI is often necessary because it minimizes the risk for lenders. When you pay less than 20% upfront, the lender considers the loan riskier. By requiring PMI, lenders can protect themselves against potential losses if a borrower defaults.

Risk Assessment in Lending

Lenders assess risk based on the borrower’s financial profile and the loan’s characteristics. A lower down payment increases the loan-to-value ratio (LTV), which signals higher risk. PMI serves as a risk mitigation tool, allowing lenders to approve loans with higher LTV ratios. This flexibility benefits both lenders and borrowers, as it expands access to mortgage financing.

The Borrower’s Advantage

For borrowers, PMI can be a beneficial tool. It allows you to purchase a home sooner without waiting to save for a larger down payment. Even though it adds to your monthly expenses, the ability to secure a home loan with a smaller down payment can be a significant advantage for many prospective homeowners. The cost of PMI is often outweighed by the benefits of owning a home and building equity over time.

PMI as a Financial Strategy

Some buyers may strategically choose to pay PMI as part of their financial planning. For instance, they might prefer to invest their available cash elsewhere rather than tying it up in a large down payment. In such cases, the cost of PMI is considered an investment in liquidity and growth potential. Understanding the strategic role of PMI can help you make informed decisions about your mortgage and financial priorities.

How PMI Works

Calculating PMI Costs

The cost of PMI varies based on several factors, including the size of your down payment, the loan amount, and your credit score. Typically, PMI ranges from 0.3% to 1.5% of the original loan amount annually. This cost is usually rolled into your monthly mortgage payment.

Factors Influencing PMI Rates

Several factors influence the cost of PMI. Your credit score plays a significant role, as borrowers with higher credit scores typically receive lower PMI rates. The amount of your down payment also affects the premium. A larger down payment reduces the loan-to-value ratio, potentially lowering your PMI cost. Additionally, the type of loan and lender policies can impact PMI rates.

Example of PMI Calculation

To understand PMI costs, consider an example: if you buy a home for $200,000 with a 5% down payment, your loan amount would be $190,000. If your PMI rate is 1%, you would pay approximately $1,900 annually, or about $158 per month, in PMI. This calculation highlights how PMI is integrated into your overall mortgage expenses.

Comparing PMI Providers

PMI costs can vary between providers, so it’s essential to compare your options. Different lenders may work with various PMI companies, each offering distinct rates and terms. Shopping around and understanding the offerings from different PMI providers can help you find the best deal for your financial situation.

Paying for PMI

PMI payments can be structured in different ways:

- Monthly Premiums: Most commonly, PMI is paid as a part of your monthly mortgage payment.

- Upfront Premiums: Some lenders allow you to pay the entire PMI premium upfront at closing.

- Combination of Both: A combination of upfront and monthly payments is also an option in some cases.

Monthly PMI Premiums

Monthly PMI premiums are the most common payment method. With this approach, the PMI cost is included in your monthly mortgage payment, spreading the expense over the life of the loan. This method is convenient for many borrowers, as it integrates seamlessly into their budgeting and financial planning.

Upfront PMI Payments

Some lenders offer the option to pay the entire PMI premium upfront at closing. While this requires a larger initial outlay, it eliminates the ongoing monthly PMI expense. Borrowers who prefer to avoid monthly PMI payments may find this option appealing, especially if they plan to stay in the home long-term.

Hybrid PMI Payment Options

In some cases, lenders may offer a hybrid approach, combining both upfront and monthly payments. This flexibility allows borrowers to tailor their PMI payments to their financial situation. Discuss these options with your lender to choose the best method for your financial situation and homeownership goals.

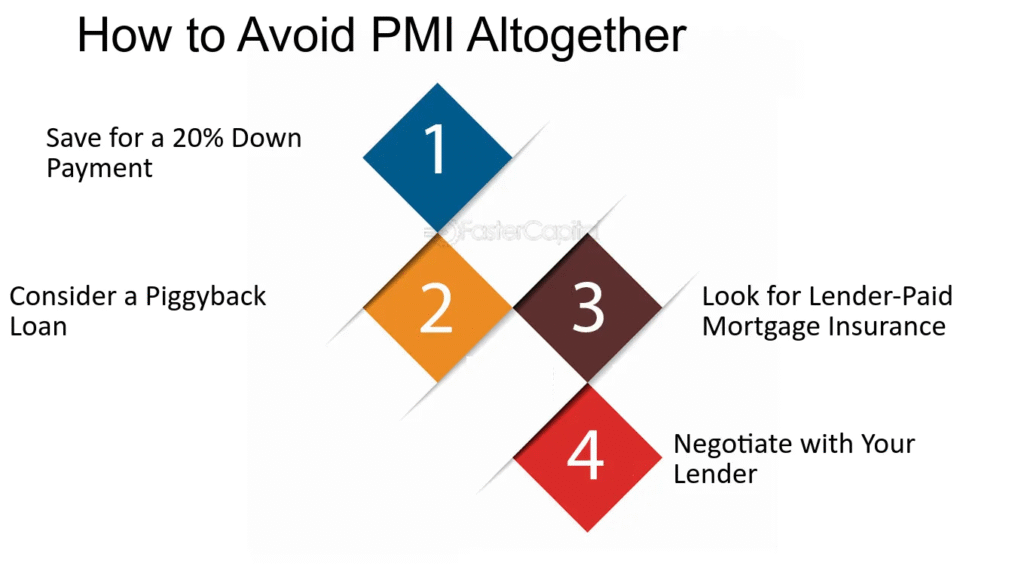

How to Avoid PMI

While PMI helps you buy a home with a lower down payment, avoiding it can save you money in the long run. Here are a few strategies to consider:

Save for a Larger Down Payment

The most straightforward way to avoid PMI is to save enough to make a 20% down payment. Though it requires patience and discipline, reaching this savings goal eliminates the need for PMI, reducing your overall loan cost.

Budgeting and Saving Strategies

Saving for a larger down payment requires careful budgeting and financial planning. Create a dedicated savings plan, setting aside a portion of your income each month. Consider automating transfers to a high-yield savings account to maximize your savings potential. By prioritizing your down payment fund, you can reach your goal more efficiently.

Exploring Down Payment Assistance Programs

Many first-time homebuyers are eligible for down payment assistance programs. These programs offer grants, loans, or other financial assistance to help you reach the 20% threshold. Research available programs in your area and consider working with a housing counselor to explore your options. These resources can make saving for a larger down payment more attainable.

Evaluating Your Financial Goals

While saving for a larger down payment is beneficial, consider your broader financial goals. Evaluate whether delaying your home purchase aligns with your long-term objectives. In some cases, the benefits of homeownership, such as building equity and tax advantages, may outweigh the cost of PMI. Assess your priorities to make an informed decision.

Consider a Piggyback Loan

A piggyback loan, also known as an 80-10-10 loan, involves taking out a second mortgage to cover part of your down payment. In this scenario, you make a 10% down payment, take a first mortgage for 80% of the home’s value, and a second mortgage for the remaining 10%. This approach can help you avoid PMI, but ensure you understand the terms of the second mortgage, as it often comes with higher interest rates.

How Piggyback Loans Work

Piggyback loans are structured to avoid PMI by breaking the mortgage into two parts. The primary mortgage covers 80% of the home’s value, while the secondary loan or home equity line of credit (HELOC) covers the remaining amount needed to avoid PMI. This strategy can be cost-effective, but it’s essential to understand the terms and potential risks associated with multiple loans.

Pros and Cons of Piggyback Loans

Piggyback loans offer several advantages, including the ability to avoid PMI and potentially lower interest rates on the primary mortgage. However, they also come with drawbacks, such as higher interest rates on the second loan and increased complexity in managing two separate loans. Carefully weigh the pros and cons to determine if this strategy aligns with your financial situation and goals.

Comparing Piggyback Loan Options

If you’re considering a piggyback loan, explore different lenders and loan structures. Some lenders may offer more favorable terms or lower rates on the second loan. Additionally, understand the repayment terms and potential impact on your monthly budget. Thoroughly researching your options ensures you choose the best piggyback loan strategy for your needs.

Look for Lender-Paid PMI

Some lenders offer Lender-Paid PMI, where they cover the insurance cost, but it typically results in a higher interest rate. While this means you don’t make separate PMI payments, your monthly payments might be higher due to the increased interest rate. Evaluate whether this option is financially beneficial in the long run.

Understanding Lender-Paid PMI

Lender-Paid PMI involves the lender covering the PMI premium, effectively embedding the cost into the mortgage interest rate. This option can simplify your monthly payments, as there’s no separate PMI charge. However, the higher interest rate may result in increased overall mortgage costs over the life of the loan.

Long-Term Financial Implications

When considering Lender-Paid PMI, assess the long-term financial implications. Calculate the total cost of the mortgage with the higher interest rate compared to a traditional PMI structure. In some cases, the convenience of Lender-Paid PMI may outweigh the added interest expense. Analyze your financial goals and timeline to determine the most cost-effective option.

Negotiating with Lenders

Lender-Paid PMI terms can vary between lenders, so it’s essential to negotiate and compare offers. Some lenders may be willing to offer lower interest rates or more favorable terms to earn your business. Don’t hesitate to discuss your options with multiple lenders to find the best deal that aligns with your financial objectives.

Cancelling PMI

The good news is that PMI doesn’t have to last forever. There are several ways to cancel PMI once you meet certain conditions:

Automatic Cancellation

Under the Homeowners Protection Act, lenders must automatically cancel PMI when your loan balance reaches 78% of the original property value, as long as you’re current on your payments.

Understanding Automatic Cancellation

Automatic cancellation of PMI is a protection afforded to borrowers under the Homeowners Protection Act. This legislation ensures that PMI is removed once the loan balance reaches 78% of the original property value, provided you’re up-to-date with payments. This automatic process eliminates the need for borrowers to take any action, offering peace of mind and cost savings.

Tracking Your Loan Balance

To anticipate automatic cancellation, regularly monitor your loan balance and property value. Most lenders provide online account access, allowing you to track your progress toward the 78% threshold. Staying informed about your loan balance helps you plan for the cancellation and manage your finances effectively.

Ensuring Eligibility for Automatic Cancellation

To qualify for automatic PMI cancellation, ensure you’re current on your mortgage payments and maintain a good payment history. Lenders require borrowers to meet specific criteria, such as no late payments in the past year. Adhering to these requirements ensures a smooth and timely cancellation process.

Requesting Cancellation

You can request PMI cancellation earlier once your loan balance reaches 80% of the original property value. To do this, you must have a good payment history, be current on your payments, and not have any additional liens on your property.

Preparing for a Cancellation Request

Before requesting PMI cancellation, gather necessary documentation, including your mortgage statements and payment history. Review your loan terms to ensure you meet the eligibility criteria for early cancellation. Having a clear understanding of the process and requirements streamlines your request and increases the likelihood of approval.

Communicating with Your Lender

When ready to request cancellation, contact your lender to initiate the process. Write a formal letter outlining your request and providing evidence of your loan balance and payment history. Clear communication with your lender facilitates a smooth and efficient cancellation process, helping you achieve your financial goals.

Following Up on Your Request

After submitting your cancellation request, follow up with your lender to confirm receipt and inquire about the timeline for processing. Lenders may require a new appraisal to verify the property’s value. Stay proactive and engaged throughout the process to ensure a successful cancellation and reduction in your mortgage expenses.

Home Value Increase

If your home’s value has increased significantly since you purchased it, you might reach the 80% threshold faster than expected. In this case, you can request a new appraisal to prove the increased value and potentially cancel PMI sooner.

Assessing Your Home’s Value

To determine if your home’s value has increased, research recent sales of comparable properties in your area. Real estate websites and local market reports provide valuable insights into property values. Understanding your home’s current market value helps you decide whether to pursue an appraisal for PMI cancellation.

The Appraisal Process

Requesting a new appraisal involves hiring a certified appraiser to assess your property’s current value. The appraiser will evaluate factors such as location, condition, and comparable sales. A positive appraisal outcome can expedite PMI cancellation and reduce your mortgage costs significantly.

Timing Your Appraisal Request

Consider timing your appraisal request strategically, especially if you anticipate further increases in your home’s value. Real estate markets fluctuate, so choosing the right moment for an appraisal can optimize your chances of achieving the 80% threshold. Collaborate with your lender to ensure the appraisal aligns with their requirements for PMI cancellation.

Conclusion

PMI is an essential aspect of the mortgage process for many homebuyers, especially those unable to make a 20% down payment. Understanding how PMI works, its costs, and how to manage or avoid it can help you make informed decisions during your home buying journey.

By exploring options like saving for a larger down payment, considering piggyback loans, or opting for lender-paid PMI, you can potentially reduce or eliminate PMI costs. Additionally, knowing how and when you can cancel PMI can save you money over the life of your mortgage.

As you embark on the path to homeownership, remember to discuss your options with your lender and choose the best strategy for your financial situation. With the right approach, you’ll be well on your way to making your homeownership dreams a reality. Equip yourself with knowledge and take advantage of available resources to navigate the complexities of PMI effectively. Your journey to homeownership is a significant milestone, and understanding PMI is a crucial step toward achieving it confidently.